Cost accounting methods are typically not used to determine tax liabilities. Cost accounting is not compliant with generally accepted accounting principles (GAAP); this accounting method is only used by businesses for internal purposes. An expense refers to the consumption of assets for the purpose of generating revenue. Cost is the sacrifice made that is usually measured by the resources given up to achieve a particular purpose.

- Indirect costs cannot be directly allocated to cost units or cost centres and have to be absorbed or recovered into cost units.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- Salaries and wages, dearness and other allowances, production incentive or bonus.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

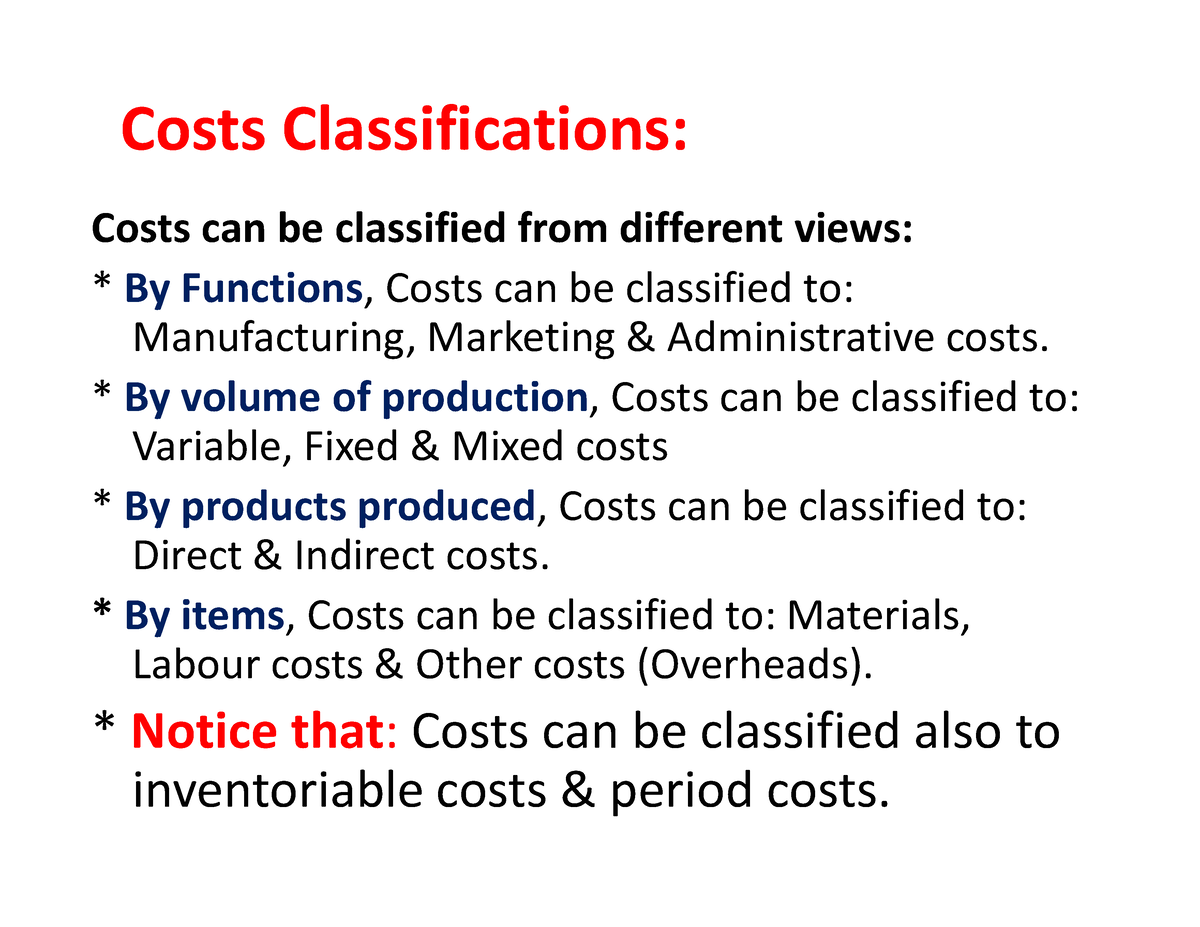

Cost Classifications in Managerial Accounting

The efficiency or quantity of the input used is considered a volume variance. For example, if XYZ company expected to produce 400 widgets in a period but ended up producing 500 widgets, the cost of materials would be higher due to the total quantity (volume) produced. For example, nails and glue used in the manufacturing of a table are examples of indirect materials. All materials involved in the production of a product that are not direct materials are indirect materials. These costs are created decisions made in the past that cannot be changed by any decision that will be made in the future. Written down values of any asset previously purchased are an example of sunk costs.

How Does Cost Accounting Differ From Traditional Accounting Methods?

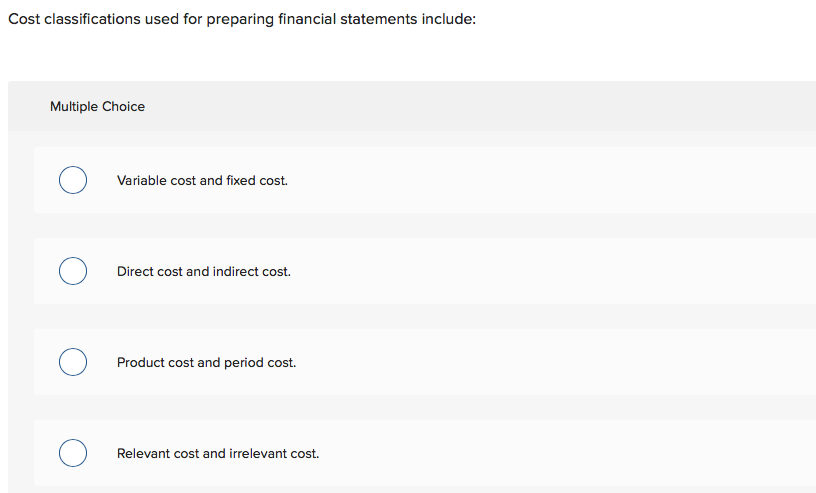

Activity-based costing takes overhead costs from different departments and pairs them with certain cost objects. Lean accounting replaces traditional costing methods with value-based pricing. Marginal costing evaluates the impact on cost by adding one additional unit into production. The different categories of cost classification include fixed costs, variable costs, direct costs, indirect costs, and semi-variable costs.

Business costs

No matter where you choose to purchase your frog cremation urn, be sure to do your research, read reviews, and ask questions to ensure you’re getting a high-quality product that will honor your frog’s memory for years to come. With the right urn, you can create a lasting and meaningful tribute to your cherished amphibian friend. If you’re looking to support small businesses and local artisans, consider searching for frog urn makers on online marketplaces like Etsy or visiting local craft fairs and festivals. These venues often showcase one-of-a-kind, custom-made frog urns that are truly special and meaningful.

These are the costs other than material cost or labour cost which are involved in an activity. Expenditure on account of utilities, payment for bought-out services, job processing charges etc. can be termed as expenses. Variable costing describes when only variable manufacturing costs are inventoried, and fixed manufacturing cost is treated as an expense at the time period in which it is incurred (that is, period costs). Cost measurement and allocation are significant aspects of financial and management accounting. Cost measurement and allocation techniques are used not only to assign incurred costs to products or services but also to plan future activities. Non-manufacturing costs – not incurred in transforming materials to finished goods.

Overhead Allocation

A direct cost is an amount that can be traced to a specific department, process or job. Direct costs can be product costs like direct materials or direct labor or they can be period costs like an accountant’s salary would be traced to the accounting department. Indirect costs is an amount that cannot be traced to a specific department, process or job. These costs are typically allocated (or estimated) to the departments, processes or jobs using those items. Indirect costs can be product costs like overhead or period costs like an IT employee’s salary to the sales department.

Let us help you create a lasting tribute that will keep the memory of your beloved frog alive for generations to come. When it comes to frog cremation urns, the options are as diverse as the frogs themselves. From classic designs to avant-garde masterpieces, there’s a frog urn to suit every taste and preference. Are you looking for a unique and meaningful way to honor the memory of your beloved frog?

Notably, opportunity cost only applies to resources that have some alternative uses. The main difference is that marginal cost represents the additional cost of one extra unit of output, whereas incremental cost represents the additional cost resulting from a group of additional units of output. A variable cost changes in direct proportion to a change in the level of tax freedom day by state activity. Period costs (expenses) incurred in and due to administrative activities. An indirect cost is a cost that cannot be identified with specific segments of operations. This type of category is generally used by the companies involved in the manufacturing business where there are a lot of processes to be followed by the product to become a finished product.

When spoilage occurs in manufacture in excess of normal limit, the resulting cost of spoilage is avoidable cost. The avoidable cost will not be incurred if an activity is not undertaken or discontinued. The replacement cost is a cost at which material identical to that is to be replaced could be purchased at the date of valuation (as distinct from actual cost price at the date of purchase). The replacement cost is a cost of replacing an asset at any given point of time either at present or in the future (excluding any element attributable to improvement).

By working closely with the urn maker, you can create a truly unique and cherished memorial that captures the essence of your frog and the bond you shared. Whether it’s a simple engraving or an elaborate sculptural design, the customized urn will serve as a lasting tribute to your beloved amphibian companion. For those who prefer a more hands-on shopping experience, local funeral homes and pet crematoriums can be excellent sources for frog cremation urns. These establishments typically have a curated selection of urns, and the staff can provide personalized guidance to help you choose the perfect option.